Struggling to manage your money and need budgeting tips to get started? Whether you’re unsure where your cash is going or feel like you’re spending more than you make, it’s time to take control with a beginner budget! In this guide, Blogging Brandi and Fancy Financials break down the budgeting basics so you can learn how to budget for beginners and finally take charge of your finances.

If you’re ready to stop stressing over money, follow these 3 EASY steps to start budgeting and get the financial advice you need to build a solid plan. This is your go-to resource for how to start a budget, how to start budgeting, and financial planning that actually works. Let’s dive in to beginner budgeting 101!

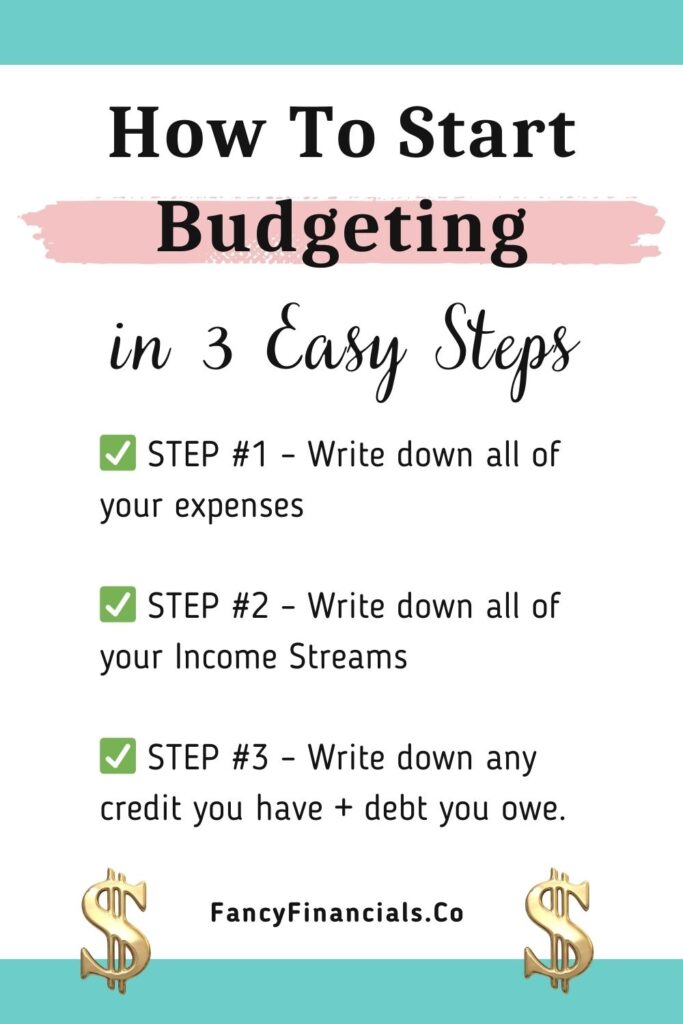

❗️How To Start Budgeting:

These are the 3 basic steps need to get your finances in order and how to budget for beginners:

- ✅ STEP #1 – Write down all of your expenses

- ✅ STEP #2 – Write down all of your Income Streams

- ✅ STEP #3 – Write down any credit you have + debt you owe

✅ STEP #1 – Write down all of your expenses

Go through your bank statements, and online transactions, to start tracking all of your daily, monthly, and annual living expenses. Write down EVERYTHING you are spending money on! Both needs and wants — meaning all the necessities and non-necessary items your income goes towards! You have to figure out where your money is going before you can find a way to fix it!

>> Ultimate List: Money Saving Ideas, Tips & Tricks!

✅ STEP #2 – Write down all of your Income Streams

Take a second to track all your MONEY and income streams! I.e. your paycheck, disability check, pension payment, checking account, savings account, investment accounts, 401k, etc… HOW MUCH MONEY do you have already in the bank or under your bed? And, How much is coming in each day, week, month, year? Plus, think about any assets you own that could be worth money… (for example your Car, house, and belongings)

>> 50+ Business Ideas To Make Money Online

✅ STEP #3 – Write down any credit you have + debt you owe

Go through your credit card statements! Look at your credit report. You’ll want to track things like: your total balance owed, your minimum payment, when it’s due, the interest rate and amount of money going to interest vs principal, plus your available credit. (i.e. Credit Cards, Personal Loans, Auto Loans, Student Loans, etc…)

>> Everything You Need to Know About Credit Scores

👆 After you take these 3 steps…

Once you take the time to write down all your expenses, track where all your money is, plus what’s coming in and get a clear picture of any debt you owe then you can start making a “Financial Plan” to achieve your money goals! 🙌

This will allow you to sit down and SEE where all your money is coming from and where it’s going! It’s almost like MAGIC happens when you WRITE DOWN ALL THESE THINGS! 🤩

You’d be amazed how many people MAKE GOOD MONEY and have NO IDEA what to do with it or should I say where it’s all going! 🤦♀️

Do you Need some help figuring out your finances and finally beginning the Life of your dreams? Have you taken these steps yet to start budgeting? 🤔 — Drop a comment below and let me know!

Next…

Next, don’t forget to follow @FancyFinancials on Social Media via Facebook, Instagram, Twitter, Pinterest, LinkedIn, TikTok, and Subscribe on YouTube! Plus, sign up to get the Fancy Financials Newsletter sent straight to your inbox!

About Me:

Hi, if we haven’t officially met I’m Blogging Brandi and this is my Money Blog! I am an ex-corporate Kool-Aid Drinker, Born to be a Blogger, Creator, and Entrepreneur. I also LOVE my dogs and RV a lot! Plus, I have a background in Accounting, Investments, and a Finance Degree! So, I kinda, maybe, sorta, might know a thing about money! Check out the About Page for all the details! 😉

P.S. Got Questions? I’ve got answers reach out via [email protected] (or using the form on my Contact Page).

Affiliate Disclaimer: Note this description contains affiliate links that allow you to find the items mentioned and support me at no cost to you. While I may earn minimal sums when the viewer uses the links, the viewer is in no way obligated to use these links. Thank you for your support!

#Budgeting #Budget #FinancialPlanning #BudgetingTips #FancyFinancials #BeginnerBudgeting #HowToBudget #Finance #Money #Finances #BudgetAdvice #FinancialAdvice #FinancialAdvisor #MoneyMindset #Finance #FinanceTips #SaveMoney #FinancialFreedom #MoneyGoals #BudgetingForBeginners #BloggingBrandi

Related:

- Mastering the Art of Budgeting for Beginners

- Advanced Budgeting Techniques for Financial Freedom

- Budgeting for Families: Tips and Tricks

- Traveling on a Budget: How to Save Money on Vacations

Hi, if we haven’t officially met I’m Blogging Brandi and this is my Money Blog! I am an ex-corporate Kool-Aid Drinker, Born to be a Blogger, Creator, and Entrepreneur. I also LOVE my dogs and RV a lot! Plus, I have a background in Accounting, Investments, and a Finance Degree! So, I kinda, maybe, sorta, might know a thing about money! Check out the About Page for all the details! 😉