These are the BEST Personal Credit Cards for 2024! I decided to look through any personal credit cards I use and see which ones were offering exclusive deals for signing up. I’ll continue to update this list, but keep in mind some of these offers may change over time, so grab them before they are gone if they pique your interest.

Also, I like to look for bonus deals at the initial sign-up: 0% Zero Percent Balance Transfer offers (if you’re trying to pay down debt), Cash Back, and Rewards offers for spending money on almost anything! Travel, Gas, Food, etc…

Personal Credit Card Recommendations:

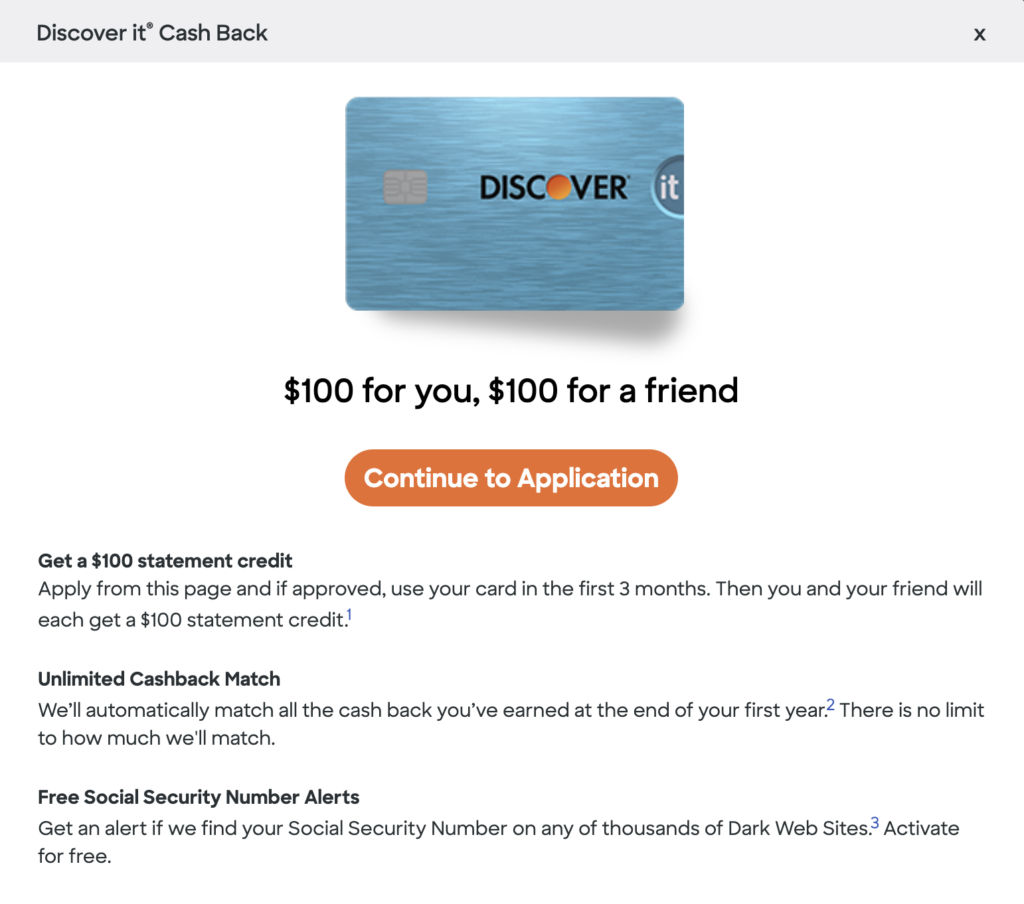

Discover it Cash Back Personal Credit Card

Get a $100 statement credit

Get a $100 Statement Credit after you apply through this referral link and make your first purchase within 3 months of being approved.

Unlimited Cashback Match

They’ll automatically match all the cash back you’ve earned at the end of your first year. There is no limit to how much they’ll match.

Free Social Security Number Alerts

Get an alert if we find your Social Security Number on any of thousands of Dark Web Sites. Activate for free.

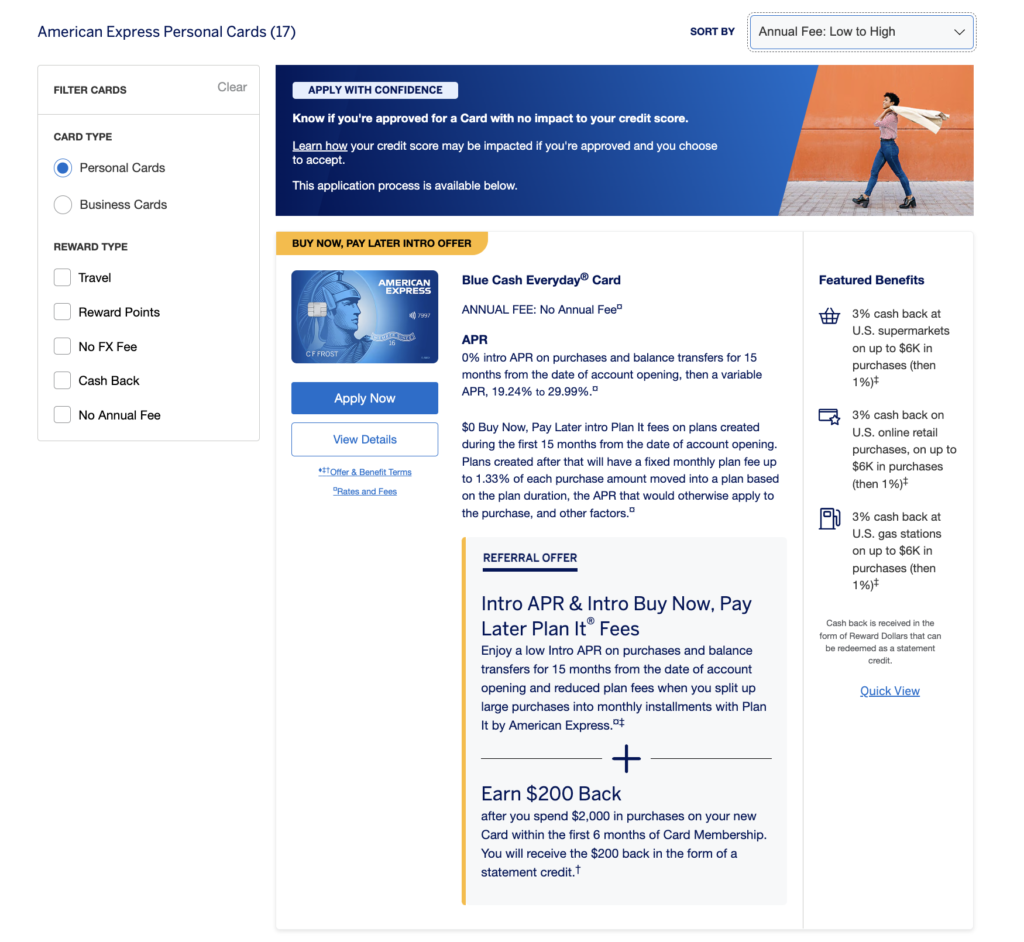

American Express Personal Credit Cards (Multiple)

Apply With Confidence

- Know if you’re approved for a Card with no impact to your credit score.

- Learn how your credit score may be impacted if you’re approved and you choose to accept.

- This application process is available with our special referral link!

You’re invited to receive an exclusive offer with American Express®. They have both personal and business credit card offers available to choose from. You can earn a referral welcome offer and we can earn a referral bonus if you are approved. Terms Apply.

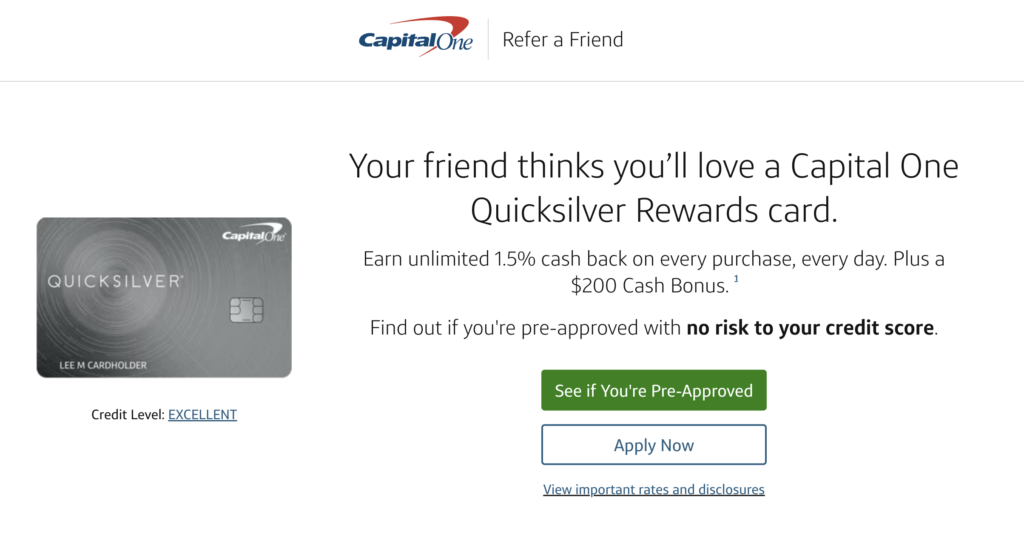

Capital One Quicksilver Rewards Personal Credit Card

We think you’ll love a Capital One Quicksilver Rewards personal credit card. Earn unlimited 1.5% cash back on every purchase, every day. Plus a $200 Cash Bonus. Even better you can Find out if you’re pre-approved with no risk to your credit score. Apply with our special Referral link for these exclusive offers and more!

CARD DETAILS:

- Unlimited Rewards: Earn unlimited 1.5% cash back on every purchase, every day.

- New Cardmember Offer: Earn a one-time $200 cash bonus once you spend $500 on purchases within 3 months from account opening.

- PURCHASE RATE: 0% intro APR for 15 months; 19.99% – 29.99% variable APR after that

- TRANSFER FEE: 0% intro APR for 15 months; 19.99% – 29.99% variable APR after that; Balance transfer fee applies. See pricing and terms for details

- ANNUAL FEE: $0

Everything You Need To Know About Your Credit Score, History, Reports, and More!

Don’t Miss A Thing…

Be sure to follow @FancyFinancials on Social Media via Facebook, Instagram, Twitter, Pinterest, LinkedIn, and Subscribe on YouTube! Plus, sign up to get the Fancy Financials Newsletter sent straight to your inbox!

Affiliate Disclaimer: Note this description contains affiliate links that allow you to find the items mentioned and support me at no cost to you. While I may earn minimal sums when the viewer uses the links, the viewer is in no way obligated to use these links. Thank you for your support!

Related:

- Black credit cards are the ultimate status symbol — but what are they?

- How Many Credit Cards Should I Have?

- How Long To Wait Between Credit Card Applications

- Should You Cancel Your Unused Credit Cards or Keep Them?

- Best Credit Cards For Business

Hi, if we haven’t officially met I’m Blogging Brandi and this is my Money Blog! I am an ex-corporate Kool-Aid Drinker, Born to be a Blogger, Creator, and Entrepreneur. I also LOVE my dogs and RV a lot! Plus, I have a background in Accounting, Investments, and a Finance Degree! So, I kinda, maybe, sorta, might know a thing about money! Check out the About Page for all the details! 😉