Need help picking a Business Credit Card? Wondering Which are the best credit cards for business owners, or better yet, What credit card can I get with my LLC? Looking for The Best Small-Business Credit Cards? Follow the Business Credit Card Advice & Guides outline in this post to find and apply for the Best Credit to suit your business needs!

I’ve compiled a list of the:

- Best credit cards for business startups

- Best credit cards for business expenses

- Best credit cards for business travel

- Best credit cards for businesses with no credit

Top Business Credit Cards:

Here is a list of Business Credit Cards I would recommend since I have used them for my own businesses!

- Chase Ink For Business Credit Cards

- American Express Blue Business Plus Credit Card

- Marriott Bonvoy American Express Business Credit Card

- Capital One Spark 1% Classic (Great for businesses that want to build credit!)

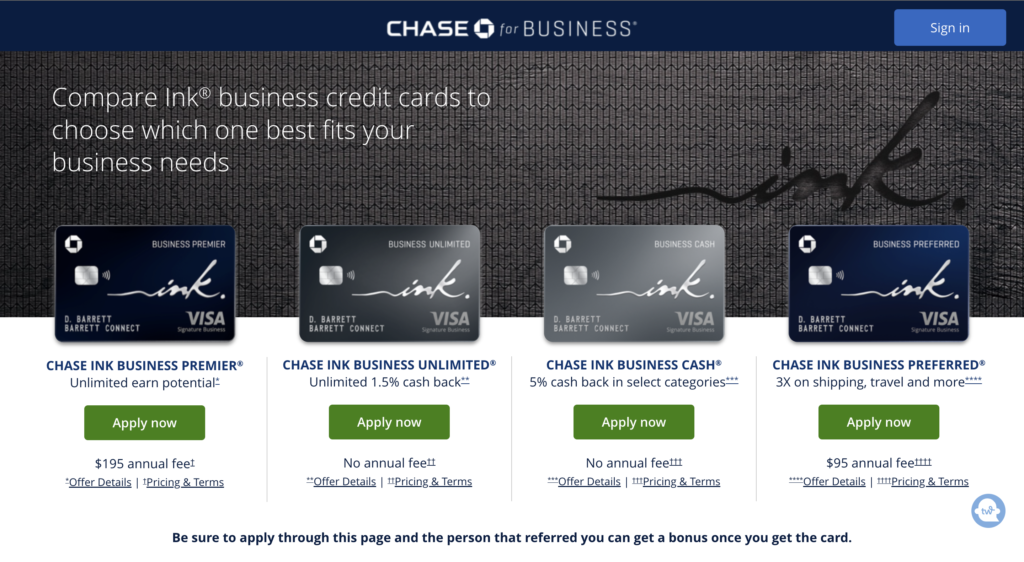

Chase Ink For Business Credit Cards

Compare Chase Ink® business credit cards to choose which one best fits your business needs. Each one has its own exclusive New Card Member Offers, Earning Rewards, and Pricing Structures for APR, Purchases, Balance Transfers, Fees, and more… Be sure to apply through this page so that we get credit for referring you and you can get access to these bonuses once you get the card!

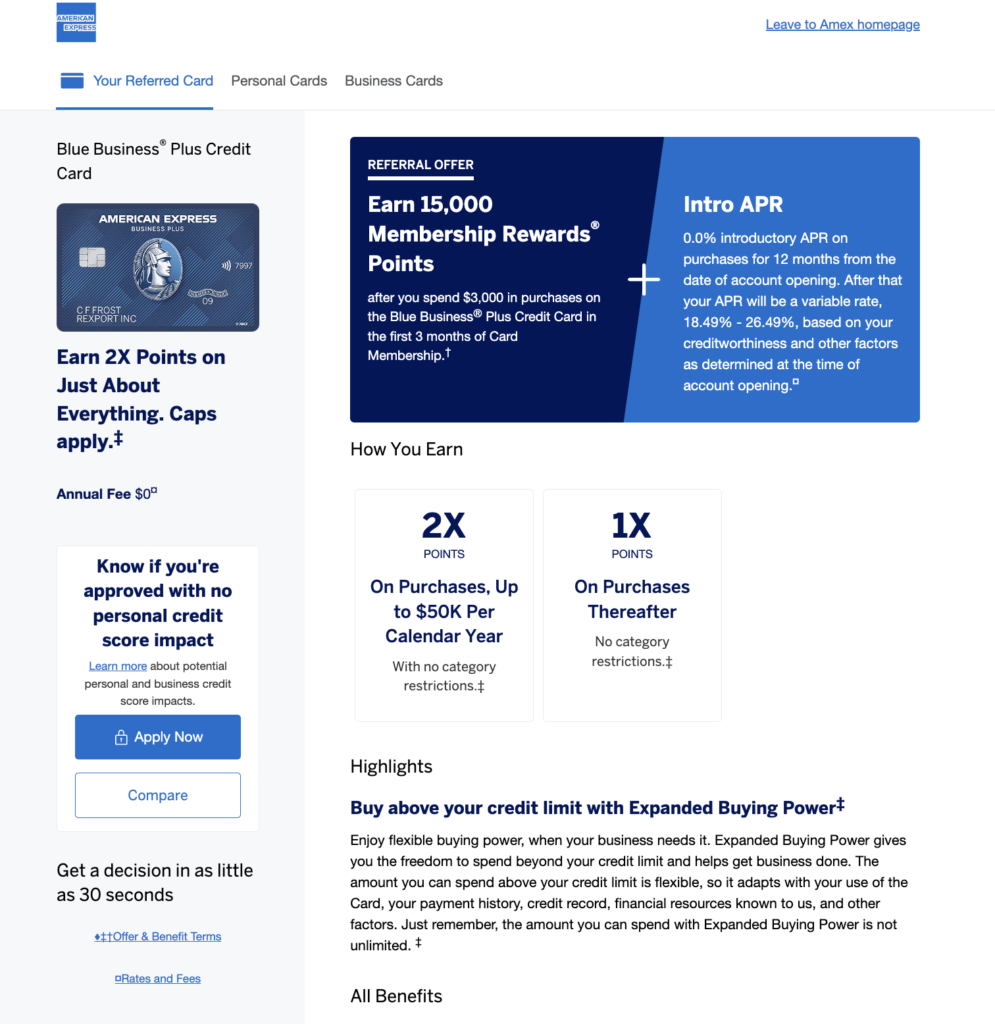

American Express Blue Business® Plus Credit Card

REFERRAL OFFER:

- Earn 15,000 Membership Rewards Points after you spend $3,000 in purchases on the Blue Business® Plus Credit Card in the first 3 months of Card Membership.

- Earn 2X Points on Just About Everything.

- Intro APR: 0.0% introductory APR on purchases for 12 months from the date of account opening. After that your APR will be a variable rate, 18.49% – 26.49%, based on your creditworthiness and other factors as determined at the time of account opening.

- Annual Fee $0

- Buy above your credit limit with Expanded Buying Power: Enjoy flexible buying power, when your business needs it. Expanded Buying Power gives you the freedom to spend beyond your credit limit and helps get business done. The amount you can spend above your credit limit is flexible, so it adapts with your use of the Card, your payment history, credit record, financial resources known to us, and other factors. Just remember, the amount you can spend with Expanded Buying Power is not unlimited.

- Plus Additional Benefits including Expense Management Tools, Travel Benefits, and more!

- Know if you’re approved with no personal credit score impact! Get a decision in as little as 30 seconds

With your new Card, you could earn a welcome bonus and we could earn a referral bonus. Terms Apply. Use this special referral link to apply for the American Express Blue Business® Plus Credit Card.

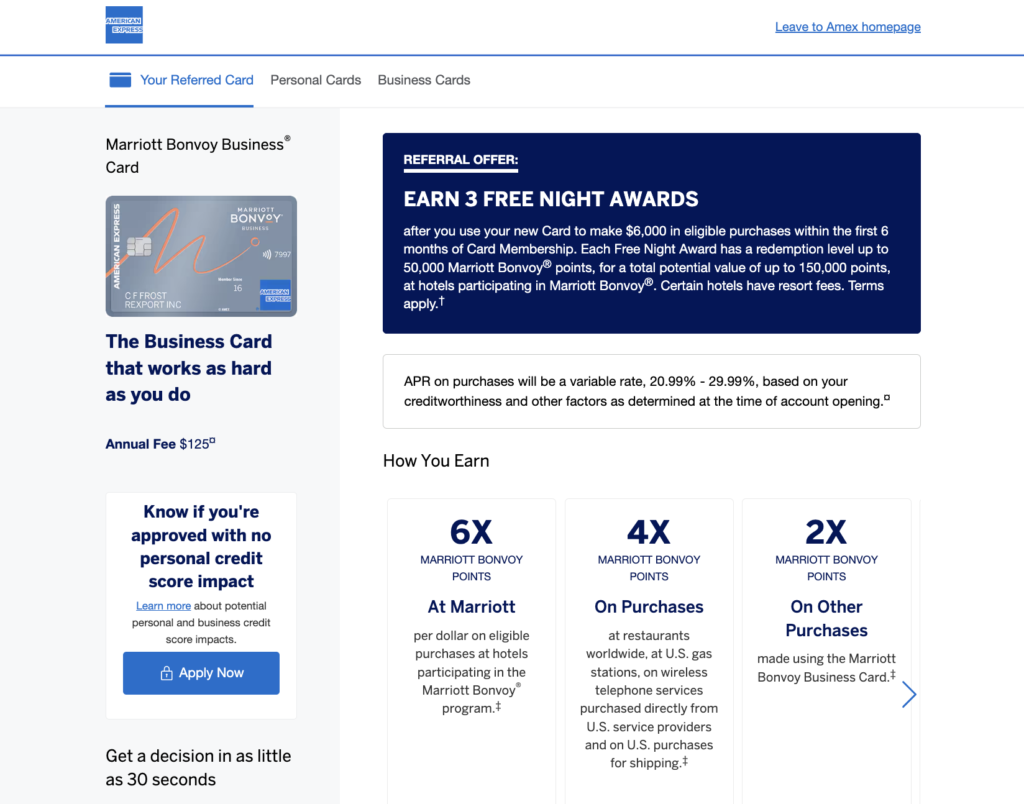

Marriott Bonvoy Business Credit Card (American Express)

BONUS REFERRAL OFFER:

- EARN 3 FREE NIGHT AWARDS after you use your new Card to make $6,000 in eligible purchases within the first 6 months of Card Membership. Each Free Night Award has a redemption level up to 50,000 Marriott Bonvoy® points, for a total potential value of up to 150,000 points, at hotels participating in Marriott Bonvoy®. Certain hotels have resort fees. Terms apply.

CARD HIGHLIGHTS

- Complimentary Marriott Bonvoy Gold Elite Status: Receive complimentary Gold Elite Status with your Card, which includes 2PM priority late checkout when available and 25% bonus points on stays. Benefits are only available for Qualifying Rates.

- Earn & Redeem a Free Night Award: Receive 1 Free Night Award every year after your Card renewal month. Award can be used for one night (redemption level at or under 35,000 Marriott Bonvoy® points) at hotels participating in Marriott Bonvoy®. Certain hotels have resort fees.‡

- 7% Marriott Bonvoy Room Rate Discount: Receive a 7% discount on eligible bookings as a benefit of being both a Marriott Bonvoy® member & a Marriott Bonvoy Business® American Express® Card Member when you book directly with Marriott through an eligible channel for a participating property under the Amex Business Card Rate. Terms and Conditions Apply.

- Marriott Bonvoy Air+Car Transfer Program: Air+Car allows members to redeem Marriott Bonvoy points for flights and car rentals across hundreds of travel partners around the world.

- Premium On-property Internet Access: Enjoy complimentary in-room, premium Internet access while staying at hotels participating in Marriott Bonvoy. Booking requirements apply.

- 15 Elite Night Credits: Each calendar year you can receive 15 Elite Night Credits towards the next level of Marriott Bonvoy® Elite status on the Marriott Bonvoy Business® American Express® Card. Limitations apply per Marriott Bonvoy member account. The benefit is not exclusive to Cards offered by American Express. Terms apply.

- Annual Fee $125

- APR on purchases will be a variable rate, 20.99% – 29.99%, based on your creditworthiness and other factors as determined at the time of account opening.

HOW YOU EARN:

- 6X MARRIOTT BONVOY POINTS At Marriott per dollar on eligible purchases at hotels participating in the Marriott Bonvoy® program.

- 4X MARRIOTT BONVOY POINTS On Purchases at restaurants worldwide, at U.S. gas stations, on wireless telephone services purchased directly from U.S. service providers and on U.S. purchases for shipping

- 2X MARRIOTT BONVOY POINTS On Other Purchases made using the Marriott Bonvoy Business Card.

This is a special referral link for the Marriott Bonvoy Business Credit Card. With your new Card, you could earn a welcome bonus and we could earn a referral bonus. Terms Apply. Know if you’re approved with no personal credit score impact. Get a decision in as little as 30 seconds!

Capital One Spark 1% Classic Business Credit Card

The Capital One Spark 1% Classic is Great for businesses that want to build credit!

- Credit Level: FAIR

Unlimited 1% cash back on every purchase with no minimums or expiration date - Annual Fee $0

- Purchase Rate: 29.99% variable APR

- Transfer Info 29.99% variable APR; No Transfer Fee with this Transfer APR

- Business Grade Benefits: Access professional tools and capabilities designed specifically to help your business grow.

We think you’ll love a Capital One Business card! That’s because you could earn unlimited rewards on every purchase—just like we do. So, go ahead— apply now.

Don’t Miss A Thing…

Be sure to follow @FancyFinancials on Social Media via Facebook, Instagram, Twitter, Pinterest, LinkedIn, and Subscribe on YouTube! Plus, sign up to get the Fancy Financials Newsletter sent straight to your inbox!

Affiliate Disclaimer: Note this description contains affiliate links that allow you to find the items mentioned and support me at no cost to you. While I may earn minimal sums when the viewer uses the links, the viewer is in no way obligated to use these links. Thank you for your support!

Related:

- The Best Small-Business Credit Cards

- What credit card can I get with my LLC? (Best Business Credit Cards for LLCs)

- Business Credit Card Advice & Guides

- Need help picking a Business Credit Card?

- Best Personal Credit Cards

Hi, if we haven’t officially met I’m Blogging Brandi and this is my Money Blog! I am an ex-corporate Kool-Aid Drinker, Born to be a Blogger, Creator, and Entrepreneur. I also LOVE my dogs and RV a lot! Plus, I have a background in Accounting, Investments, and a Finance Degree! So, I kinda, maybe, sorta, might know a thing about money! Check out the About Page for all the details! 😉